After almost two years of subdued venture capital activity, the US startup ecosystem is displaying strong signs of recovery. With inflation in check, investor confidence back, and innovation at an overdrive, American startups, particularly those in the technology space, have entered a new phase of rapid growth.

The End of a Prolonged Funding Slowdown

From 2023 through late 2024, the investment climate was unfavorable for early-stage companies. A rising interest rate, cautious investors, and market volatility combined into one of the most hostile funding climates in recent memory.

Market conditions begin to improve.

Entering 2025, economic indicators started turning.

- Interest rates stabilized.

- Capital markets strengthened

- Institutional investors resumed high-growth allocations

The changes then precipitated a gradual increase in the deployment of venture capital, especially to technology-driven startups.

Tech Sector Leads the New Wave of Growth

The technology sector is the leading driver of America’s business rebound. AI, automation, enterprise software, and robotics attract investors’ attention at an unprecedented rate.

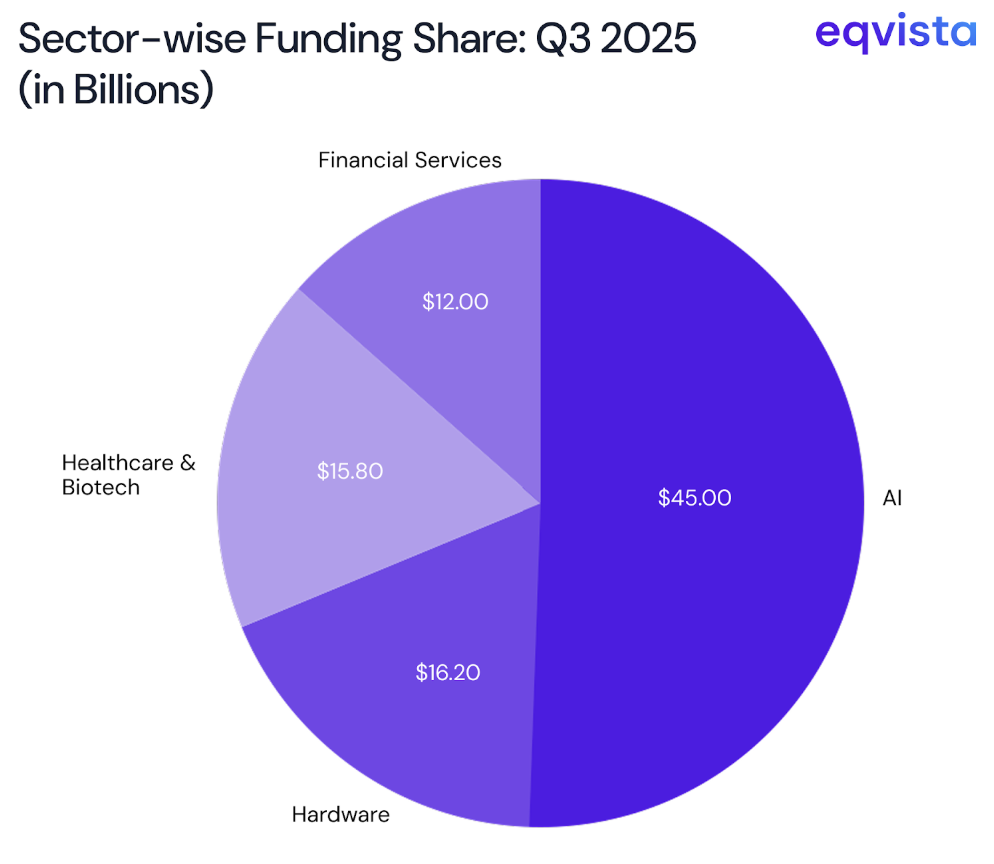

Funding Rounds Dominated by AI and Automation

AI-based solutions targeting productivity and cost-efficiency have seen the fastest growth. Startups developing:

- machine learning infrastructure

- AI workflow automation tools

- data-driven decision systems

Consistently lead in the number and size of funding rounds.

Corporate Venture Capital Pushes Innovation Forward

Large U.S. corporations are increasingly focusing on long-term innovation strategies, and thus increasing their venture investments to accelerate technology adoption across industries.

Investors favour firms with sustainable business models.

Unlike in previous funding booms, today’s investors are more cautious, focusing on long-term sustainability over rapid, high-burn expansion.

Profitability Paths Now a Necessity

- Venture capital firms now require:

- clear revenue models

- strong unit economics

- responsible cash flow management

That’s now changing, with the shift causing startup founders to turn to more disciplined strategies supporting long-term stable growth.

Outlook Positive for 2025 and Beyond

With improved credit conditions, workforce expansion, and strong demand for AI-driven solutions, the U.S. may well embark on one of its strongest innovation cycles in over a decade. Analysts believe that startup growth will be pushed even further.

Entrepreneurship Positioned for a Record Year

With increased access to capital and rapidly expanding tech infrastructure, commentators believe that

- more new startup formations will emerge.

- AI-driven businesses will lead growth.

- Innovation hubs will extend beyond the key tech cities.

This positions the U.S. for a powerful new wave of economic expansion.

Final Thoughts

At this turning point for the national economy, the resurgence in U.S. startup activity is very important. The year 2025 promises to be one of defining moments for American innovation, entrepreneurship, and sustainable business growth, propelled into the forefront by technology and restored investor confidence. Startups working on technology-driven solutions with strong fundamentals and scalable business models are well-positioned to drive the next generation of economic success within the United States.